A Beginner’s Guide to Property Investment in Greece for First-Time Buyers

Table of Contents

- Introduction to Greek Property Market

- Legal Considerations for Foreign Investors

- Popular Regions for Property Investment

- Types of Properties Available

- The Buying Process

- Financing Your Greek Property

- Taxation and Ongoing Costs

- Rental Market Potential

- Risks and Challenges

- Future Outlook for Greek Real Estate

- Conclusion

- FAQs

1. Introduction to Greek Property Market

Greece, with its rich history, stunning landscapes, and Mediterranean charm, has long been an attractive destination for property investors. The Greek property market has experienced significant fluctuations over the past decade, largely due to the country’s economic challenges. However, recent years have shown promising signs of recovery, making it an opportune time for first-time buyers to consider investing in Greek real estate.

The market has been characterized by a combination of factors that make it particularly appealing to foreign investors:

- Relatively low property prices compared to other European destinations

- A diverse range of properties, from city apartments to island villas

- Potential for high rental yields, especially in tourist-heavy areas

- Ongoing infrastructure improvements and urban regeneration projects

- The Golden Visa program, offering residency permits for significant investments

As we delve deeper into this guide, we’ll explore these factors in detail, providing you with a comprehensive understanding of the Greek property market landscape.

2. Legal Considerations for Foreign Investors

Before embarking on your Greek property investment journey, it’s crucial to understand the legal framework governing foreign ownership of real estate in Greece. While the country generally welcomes foreign investment, there are specific regulations and procedures that investors must navigate.

Key Legal Points for Foreign Buyers

- Ownership Rights: Most foreign nationals can freely purchase and own property in Greece. However, properties in border areas and certain islands may require additional permissions.

- Golden Visa Program: Investments of €250,000 or more in Greek real estate can qualify non-EU citizens for a residency permit, which is renewable every five years.

- Tax Registration Number (AFM): All property buyers must obtain a Greek tax registration number, which is essential for property transactions and tax purposes.

- Legal Representation: It’s highly recommended to engage a Greek lawyer to guide you through the purchasing process and ensure compliance with all legal requirements.

Understanding these legal considerations is fundamental to a smooth and successful property investment in Greece. As the market continues to evolve, staying informed about any changes in regulations is crucial for foreign investors.

3. Popular Regions for Property Investment

Greece offers a diverse range of locations for property investment, each with its unique characteristics and appeal. From bustling urban centers to serene island paradises, the choice of location can significantly impact your investment’s potential returns and lifestyle benefits.

Urban Centers

Athens: The capital city has seen a resurgence in property investment, particularly in areas like Kolonaki, Plaka, and Psyrri. These neighborhoods offer a mix of historical charm and modern amenities, attracting both long-term residents and short-term tourists.

Thessaloniki: Greece’s second-largest city is gaining popularity among investors for its vibrant culture, universities, and relatively lower property prices compared to Athens.

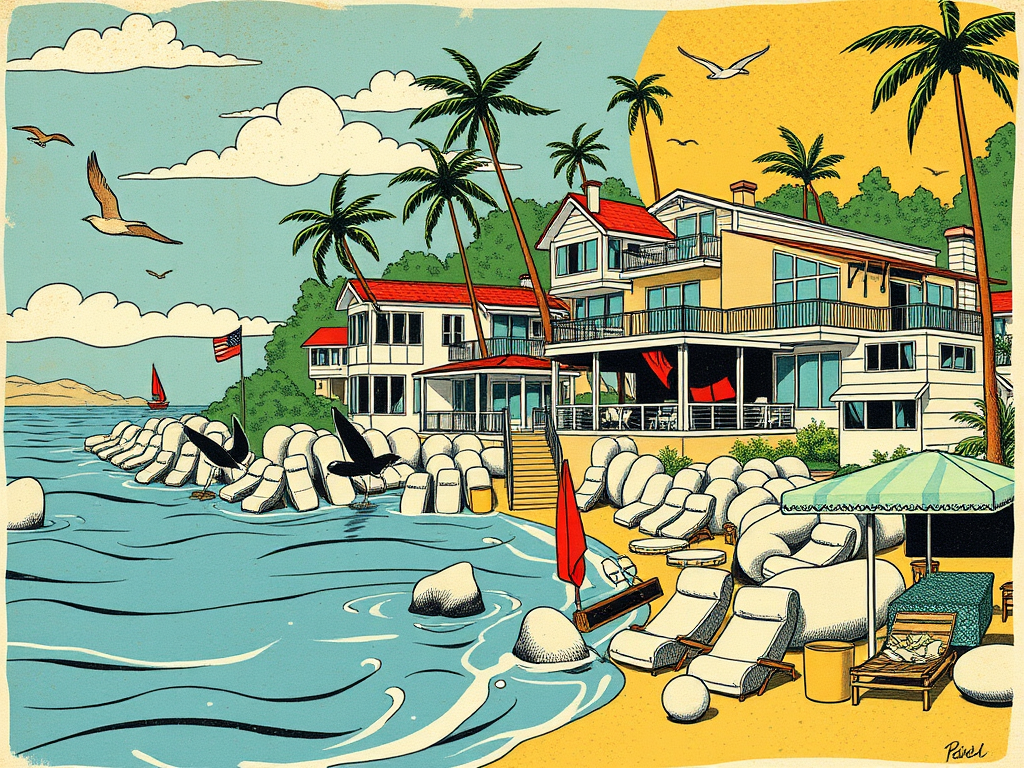

Island Destinations

Mykonos and Santorini: These iconic Cycladic islands continue to be top choices for luxury property investments, offering high rental yields during the peak tourist seasons.

Crete: As the largest Greek island, Crete offers a diverse property market, from beachfront villas to traditional stone houses in picturesque villages.

Corfu and the Ionian Islands: Known for their lush landscapes and beautiful beaches, these islands attract investors looking for a balance between tourism potential and a more relaxed lifestyle.

Mainland Coastal Areas

Halkidiki: This peninsular region in northern Greece is gaining traction among investors for its beautiful beaches and growing tourist infrastructure.

Peloponnese: Offering a mix of historical sites, beautiful coastlines, and traditional villages, the Peloponnese region presents diverse investment opportunities.

When choosing a location for your property investment, consider factors such as accessibility, local amenities, tourism trends, and potential for capital appreciation. Each region offers unique advantages, and your choice should align with your investment goals and personal preferences.

4. Types of Properties Available

The Greek real estate market offers a wide array of property types to suit various investment strategies and personal preferences. Understanding the different options available can help you make an informed decision that aligns with your investment goals.

Residential Properties

- Apartments: From modern city flats to traditional neoclassical buildings, apartments are popular in urban areas and tourist destinations. They often offer good rental potential and lower maintenance costs.

- Villas and Houses: Standalone properties are prevalent in suburban areas, islands, and coastal regions. These can range from modest family homes to luxurious villas with private pools.

- Maisonettes: These multi-level homes, often part of larger complexes, offer a middle ground between apartments and standalone houses.

Commercial Properties

- Retail Spaces: Shops and commercial units in high-traffic areas can provide steady rental income.

- Office Buildings: As Greece’s economy recovers, demand for office space, particularly in Athens and Thessaloniki, is increasing.

- Hotels and Guesthouses: With Greece’s strong tourism sector, hospitality properties can be lucrative investments, especially in popular tourist destinations.

Land

- Building Plots: Purchasing land for future development can be a long-term investment strategy.

- Agricultural Land: Some investors are attracted to olive groves, vineyards, or other agricultural properties, which can provide both income and lifestyle benefits.

Special Categories

- Historical Properties: Renovated neoclassical buildings or traditional stone houses can be unique investment opportunities, though they often come with specific restoration requirements.

- Off-Plan Properties: Investing in properties still under construction can offer lower entry prices but comes with additional risks.

When considering the type of property to invest in, think about factors such as your budget, desired rental yield, maintenance requirements, and personal use intentions. Each property type comes with its own set of advantages and challenges, so aligning your choice with your overall investment strategy is crucial.

5. The Buying Process

Navigating the property buying process in Greece can be complex, especially for foreign investors. Understanding the steps involved and preparing accordingly can help ensure a smooth transaction. Here’s a general overview of the buying process:

- Property Search and Selection: Begin by researching areas and properties that align with your investment goals. Working with a reputable real estate agent can be beneficial, especially if you’re not familiar with the local market.

- Legal Checks: Once you’ve found a property, your lawyer should conduct thorough legal checks to ensure there are no outstanding debts, disputes, or legal issues associated with the property.

- Make an Offer: If the legal checks are satisfactory, you can make an offer. Negotiation is common in the Greek property market, so be prepared to discuss the price.

- Preliminary Agreement: Once an offer is accepted, a preliminary agreement (προσύμφωνο) is typically signed. This document outlines the terms of the sale and usually requires a deposit (often 10% of the purchase price).

- Obtain Tax Registration Number (AFM): If you don’t already have one, you’ll need to obtain a Greek tax registration number. This is crucial for property transactions and ongoing tax obligations.

- Secure Financing: If you’re not paying cash, arrange your financing. This may involve a Greek bank or an international lender.

- Final Contract and Payment: The final contract (συμβόλαιο) is signed before a notary public. The remaining balance is paid at this time, and ownership is officially transferred.

- Registration: The property must be registered at the local land registry or cadastre office to complete the transfer of ownership.

Throughout this process, it’s crucial to work with experienced professionals, including a lawyer and potentially a tax advisor, to ensure compliance with all legal and financial requirements. The timeframe for completing a property purchase in Greece can vary but typically takes between one to three months from offer acceptance to final contract signing.

6. Financing Your Greek Property

Financing a property purchase in Greece can be approached through various methods, each with its own advantages and considerations. Understanding your options can help you make the most financially sound decision for your investment.

Cash Purchase

Many foreign investors opt for cash purchases, especially given the relatively lower property prices in Greece compared to other European markets. Cash purchases can simplify the process and may give you an advantage in negotiations. However, this approach ties up a significant amount of capital in a single asset.

Greek Mortgage

Obtaining a mortgage from a Greek bank is possible for foreign buyers, but the process can be more complex than in your home country. Greek banks typically offer the following:

- Loan-to-value ratios of up to 70-80% for residents, potentially lower for non-residents

- Terms typically ranging from 15 to 30 years

- Both fixed and variable interest rate options

Be prepared for stringent credit checks and documentation requirements when applying for a Greek mortgage.

International Financing

Some investors choose to finance their Greek property purchase through banks in their home country or international lenders specializing in overseas property investments. This can offer more familiar terms and potentially more favorable interest rates, depending on your financial situation and the lender’s policies.

Developer Financing

In some cases, particularly for new developments or off-plan properties, developers may offer financing options. These can be attractive but should be carefully evaluated and compared with other financing methods.

Considerations for Financing

- Exchange Rate Risk: If borrowing in a currency different from your income, be aware of potential exchange rate fluctuations that could affect your repayments.

- Tax Implications: Understand how different financing methods might impact your tax situation, both in Greece and your home country.

- Future Rental Income: If you plan to rent out the property, consider how potential rental income might factor into your financing strategy.

Regardless of the financing method you choose, it’s advisable to consult with financial advisors familiar with both Greek property laws and international investment strategies to ensure you’re making the most informed decision for your circumstances.

7. Taxation and Ongoing Costs

Understanding the tax implications and ongoing costs associated with property ownership in Greece is crucial for accurate financial planning and investment evaluation. Here’s an overview of the key taxes and costs you should consider:

Purchase Taxes and Fees

- Property Transfer Tax: Currently set at 3.09% of the property’s value.

- VAT on New Properties: New buildings with permits issued after January 1, 2006, are subject to a 24% VAT instead of transfer tax.

- Notary Fees: Typically around 1-2% of the property value.

- Legal Fees: Usually 1-2% of the property value.

- Real Estate Agent Fees: If used, typically 2-2.5% of the property value.

Annual Property Taxes

- Unified Property Tax (ENFIA): An annual tax based on the property’s value, location, and other factors. Rates vary but can range from 0.1% to 1% of the property’s value.

- Municipal Taxes: Local taxes that vary by municipality, typically covering services like waste collection.

Income Tax on Rental Properties

If you plan to rent out your property, rental income is taxed at progressive rates:

- 15% for annual income up to €12,000

- 35% for income between €12,001 and €35,000

- 45% for income exceeding €35,000

Capital Gains Tax

Currently, there is a suspension on capital gains tax for property sales in Greece until 2023. After this period, a 15% tax on capital gains may be reintroduced, subject to certain conditions and exemptions.

Ongoing Maintenance Costs

- Building Maintenance: For apartments in shared buildings, expect monthly fees for common area maintenance.

- Utilities: Costs for electricity, water, heating, and internet can vary significantly depending on the property type and location.

- Insurance: While not mandatory, property insurance is highly recommended.

Considerations for Non-Resident Owners

- Non-residents may need to file annual tax returns in Greece if they earn rental income.

- Currency exchange rates can impact the real cost of taxes and fees for foreign investors.

- Double taxation agreements between Greece and your home country may affect your overall tax liability.

Given the complexity of Greek tax laws and their potential to change, it’s advisable to consult with a Greek tax professional to get the most up-to-date and personalized advice for your situation. Proper tax planning can significantly impact the profitability of your investment and help you avoid unexpected costs.

8. Rental Market Potential

The rental market in Greece presents significant opportunities for property investors, driven largely by the country’s robust tourism sector and evolving domestic housing needs. Understanding the nuances of this market can help investors maximize their returns and navigate potential challenges.

Short-Term Rentals

Greece’s popularity as a tourist destination makes short-term rentals a lucrative option for many property investors, especially in prime locations:

- High Demand Areas: Islands like Mykonos, Santorini, and Crete, as well as historical city centers in Athens and Thessaloniki, consistently see strong demand for holiday rentals.

- Seasonal Fluctuations: Be prepared for significant variations between peak summer months and the off-season, particularly in tourist-dependent areas.

- Regulatory Considerations: Short-term rental regulations have been evolving. Currently, properties must be registered with the Greek tax authorities, and there are limits on the number of properties an individual can list for short-term rentals.

Long-Term Rentals

The long-term rental market caters to both locals and expatriates, offering more stable, year-round income:

- Urban Centers: Cities like Athens and Thessaloniki have a steady demand for long-term rentals, driven by students, young professionals, and families.

- Expat Communities: Areas popular with foreign residents, such as certain island destinations or coastal regions, can provide opportunities for long-term rentals to international tenants.

- Rental Yields: While typically lower than short-term rentals, long-term leases offer more predictable income and often lower management costs.

Market Trends and Opportunities

- Digital Nomads: Greece is increasingly attracting remote workers, creating demand for properties with good internet connectivity and workspace.

- Luxury Market: High-end properties in prime locations can command premium rates, especially in the short-term rental market.

- Urban Regeneration: Areas undergoing revitalization, particularly in Athens, may offer opportunities for early investors to benefit from increasing rental demand.

Operational Considerations

- Property Management: Consider whether you’ll manage the property yourself or use a local management company, especially for short-term rentals or if you’re not based in Greece.

- Marketing: Utilize online platforms and local networks to market your property effectively.

- Legal Compliance: Stay informed about local regulations regarding rentals, including tax obligations and any restrictions on short-term leasing.

The rental market in Greece offers diverse opportunities for investors, but success requires careful consideration of location, property type, and target market. By aligning your investment strategy with market trends and maintaining a well-managed, compliant rental operation, you can potentially achieve attractive returns in this dynamic market.

9. Risks and Challenges

While property investment in Greece can offer significant opportunities, it’s crucial to be aware of the potential risks and challenges. Understanding these factors can help you make more informed decisions and better prepare for your investment journey.

Economic and Political Factors

- Economic Volatility: Greece has faced economic challenges in recent years. While there are signs of recovery, the economy remains sensitive to global economic shifts.

- Political Changes: Government policies affecting property ownership, taxation, or investment incentives can change, potentially impacting your investment.

- Euro Zone Dynamics: As part of the Euro Zone, Greece’s economy is influenced by broader European economic trends and policies.

Legal and Bureaucratic Challenges

- Complex Legal System: Navigating Greek property law can be challenging, especially for foreign investors unfamiliar with the local legal framework.

- Bureaucratic Processes: Administrative procedures can be time-consuming and sometimes opaque, requiring patience and often local assistance.

- Title Deed Issues: Some properties, especially older ones, may have unclear ownership histories or lack proper documentation.

Market-Specific Risks

- Overreliance on Tourism: Many areas heavily depend on tourism, making them vulnerable to factors affecting travel trends.

- Seasonal Demand: Rental income in many areas can be highly seasonal, affecting cash flow and overall returns.

- Property Oversupply: Some areas may face oversupply issues, particularly in the residential sector, potentially impacting property values and rental yields.

Environmental and Infrastructure Considerations

- Natural Disasters: Greece is prone to earthquakes, and some areas may be at risk of wildfires or flooding.

- Infrastructure Development: While improving, some areas may still lack robust infrastructure, which can affect property values and rental potential.

Financial Risks

- Currency Risk: For non-Euro investors, fluctuations in exchange rates can impact the real value of your investment.

- Financing Challenges: Obtaining mortgages as a foreign buyer can be more difficult and potentially come with less favorable terms.

- Unexpected Costs: Renovation costs, especially for older properties, can often exceed initial estimates.

Mitigating Risks

To navigate these challenges effectively:

- Conduct thorough due diligence before any purchase.

- Work with reputable local professionals, including lawyers and real estate agents.

- Stay informed about local and national economic and political developments.

- Consider diversifying your investment across different types of properties or locations.

- Have a clear understanding of your financial capacity and investment goals.

By being aware of these risks and challenges and taking proactive steps to address them, you can better position yourself for a successful property investment in Greece. Remember, thorough research and expert advice are key to navigating the complexities of the Greek real estate market.

10. Future Outlook for Greek Real Estate

As we look towards the future of the Greek real estate market, several factors suggest a potentially positive outlook, albeit with some areas of caution. Understanding these trends can help investors make more informed decisions about entering or expanding their presence in the Greek property market.

Economic Recovery and Growth

Greece has been showing signs of economic recovery following years of financial crisis:

- GDP growth has been positive in recent years, with projections for continued growth, barring major global economic disruptions.

- Increased foreign direct investment indicates growing confidence in the Greek economy.

- The tourism sector, a key driver of the economy, continues to show strength and potential for further growth.

Government Initiatives and Reforms

The Greek government has been implementing measures to attract investment and improve the real estate market:

- Continuation of the Golden Visa program, which has been a significant driver of foreign investment in real estate.

- Efforts to streamline bureaucratic processes and improve transparency in property transactions.

- Tax incentives for property renovations and energy efficiency upgrades.

Urban Regeneration and Infrastructure Development

Several major projects are underway or planned, which could significantly impact property values:

- The Hellinikon project in Athens, transforming the old airport into a massive mixed-use development.

- Ongoing improvements to transportation infrastructure, including upgrades to regional airports.

- Urban renewal projects in major cities, potentially creating new hotspots for property investment.

Evolving Property Market Trends

The Greek property market is adapting to changing global and local demands:

- Growing interest in sustainable and energy-efficient properties.

- Increased demand for properties suitable for remote work, driven by the rise of digital nomads and flexible work arrangements.

- Potential for growth in the luxury property segment, particularly in prime tourist locations.

Challenges and Considerations

While the outlook is generally positive, investors should be aware of potential challenges:

- Global economic uncertainties and their potential impact on tourism and foreign investment.

- Possible changes to tax laws or property regulations that could affect investment returns.

- The need for careful location selection, as some areas may face oversupply or slower appreciation.

Long-Term Perspective

For investors taking a long-term view:

- The Greek property market may offer opportunities for capital appreciation, especially in areas benefiting from development and increased demand.

- Rental yields, particularly in tourist areas and major cities, could remain attractive compared to other European markets.

- Diversification potential within the Greek market itself, from urban apartments to island villas, allows for tailored investment strategies.

In conclusion, the future outlook for Greek real estate appears cautiously optimistic. The combination of economic recovery, government initiatives, and evolving market trends suggests potential for growth and returns. However, as with any real estate investment, thorough research, careful location selection, and a clear understanding of your investment goals are crucial. The Greek property market, while promising, requires a nuanced approach that takes into account both the opportunities and the challenges present in this dynamic market.

11. Conclusion

Investing in Greek property as a first-time buyer presents a unique blend of opportunities and challenges. The allure of Greece’s stunning landscapes, rich cultural heritage, and promising economic recovery makes it an attractive destination for real estate investment. However, navigating the complexities of foreign property ownership, understanding local market dynamics, and addressing potential risks requires careful consideration and planning.

Key takeaways for potential investors include:

- The importance of thorough research and due diligence before making any investment decisions.

- The value of working with reputable local professionals, including lawyers, real estate agents, and tax advisors.

- The need to understand and comply with legal requirements and tax obligations associated with property ownership in Greece.

- The potential for attractive returns, particularly in the rental market, balanced against the risks inherent in any real estate investment.

- The long-term perspective required when investing in Greek property, considering both current market conditions and future development potentials.

As Greece continues its economic recovery and implements reforms to attract foreign investment, the real estate market may offer significant opportunities for those willing to navigate its unique landscape. Whether you’re drawn to the bustling energy of Athens, the serene beauty of the Greek islands, or the untapped potential of emerging areas, there’s a diverse range of options to suit different investment strategies and personal preferences.

Ultimately, successful property investment in Greece requires a blend of careful planning, local knowledge, and a clear understanding of your investment goals. By approaching the market with diligence, patience, and informed decision-making, first-time buyers can position themselves to benefit from the potential that Greek real estate has to offer while minimizing risks.

As you embark on your journey into Greek property investment, remember that each step, from initial research to final purchase and beyond, contributes to the overall success of your investment. Stay informed, seek expert advice when needed, and remain flexible in your approach to make the most of your venture into the Greek real estate market.

12. FAQs

-

Q: Can foreigners buy property in Greece without restrictions?

A: Generally, yes. Most foreign nationals can freely purchase and own property in Greece. However, there are some restrictions on properties in border areas and certain islands, which may require additional permissions.

-

Q: What is the Golden Visa program, and how does it relate to property investment?

A: The Golden Visa program offers residency permits to non-EU citizens who invest €250,000 or more